- CRO

Cart Abandonment: Why Most “Recovery” Strategies Don’t Recover Anything…

15 May 2025

Let’s drop the act.

People don’t “forget” their cart. They abandon it.

Not because you didn’t remind them. Because something in your flow made them doubt the decision they already made.

And if your CRO agency’s answer is “Let’s optimise the recovery emails,” you’ve got the wrong partner.

1. Insight: You Don’t Fix a Leak at the End of the Pipe

Most brands throw automation at abandonment — email, SMS, popups.

But abandonment doesn’t start at the exit. It starts with hesitation.

That moment where the shopper goes:

- “Wait. What’s this charge?”

- “Why do they need my date of birth?”

- “Do I need to create an account to buy this?”

That moment is the real problem.

And your agency should’ve audited it by now.

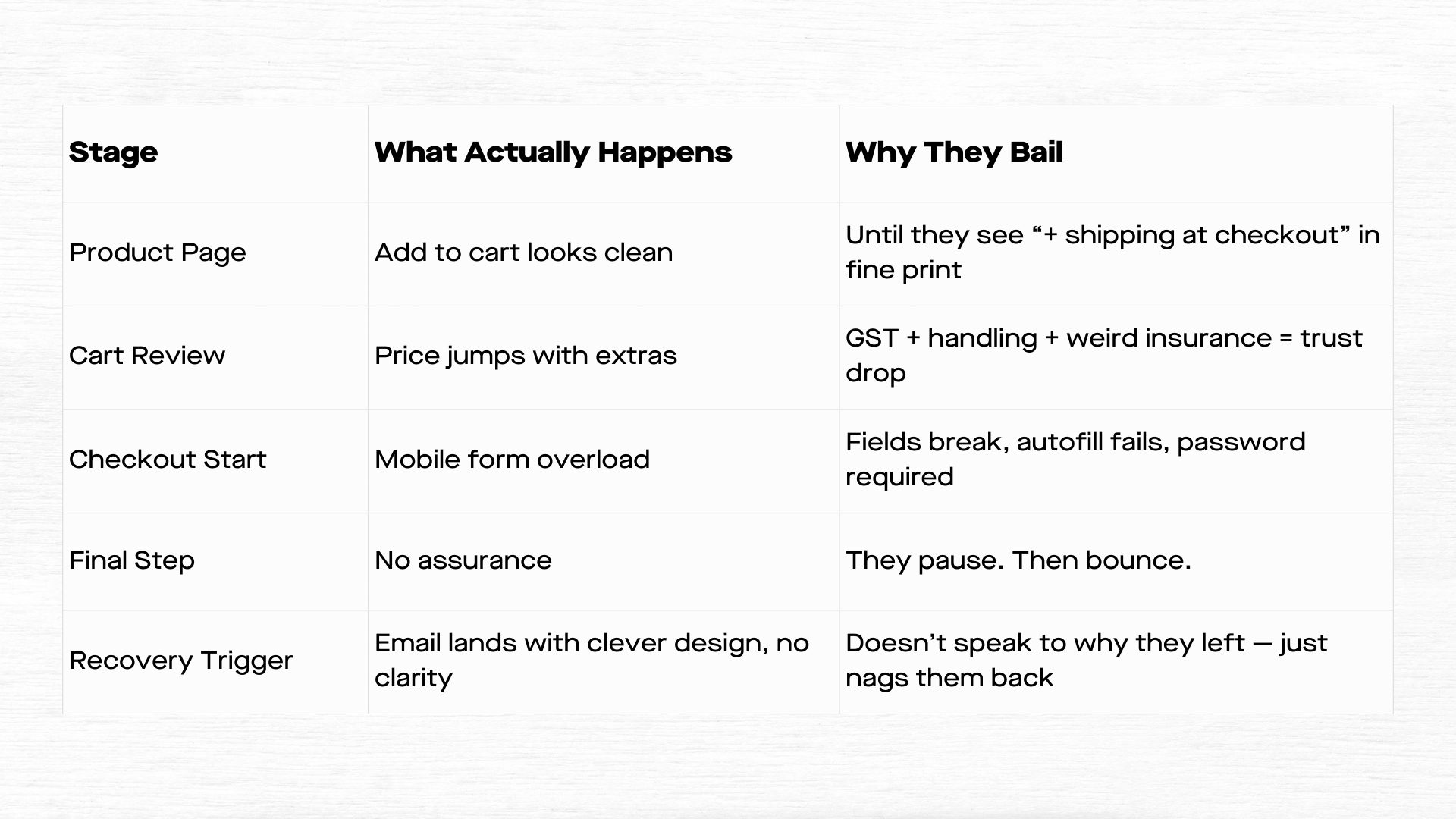

2. The Anatomy of Abandonment

Every small hesitation is a potential bounce. Recovery is about removing these moments before they happen.

3. Insight: The Abandonment Isn’t a Behaviour — It’s a Signal

You lost the sale. But the drop-off gave you insight.

Most teams look at where people dropped.

But great teams ask what was happening right before that.

That’s where real recovery starts — not from the data point, but from the friction pattern right before it.

This is where a CRO Agency actually delivers — watching the hesitation, not just the exit.

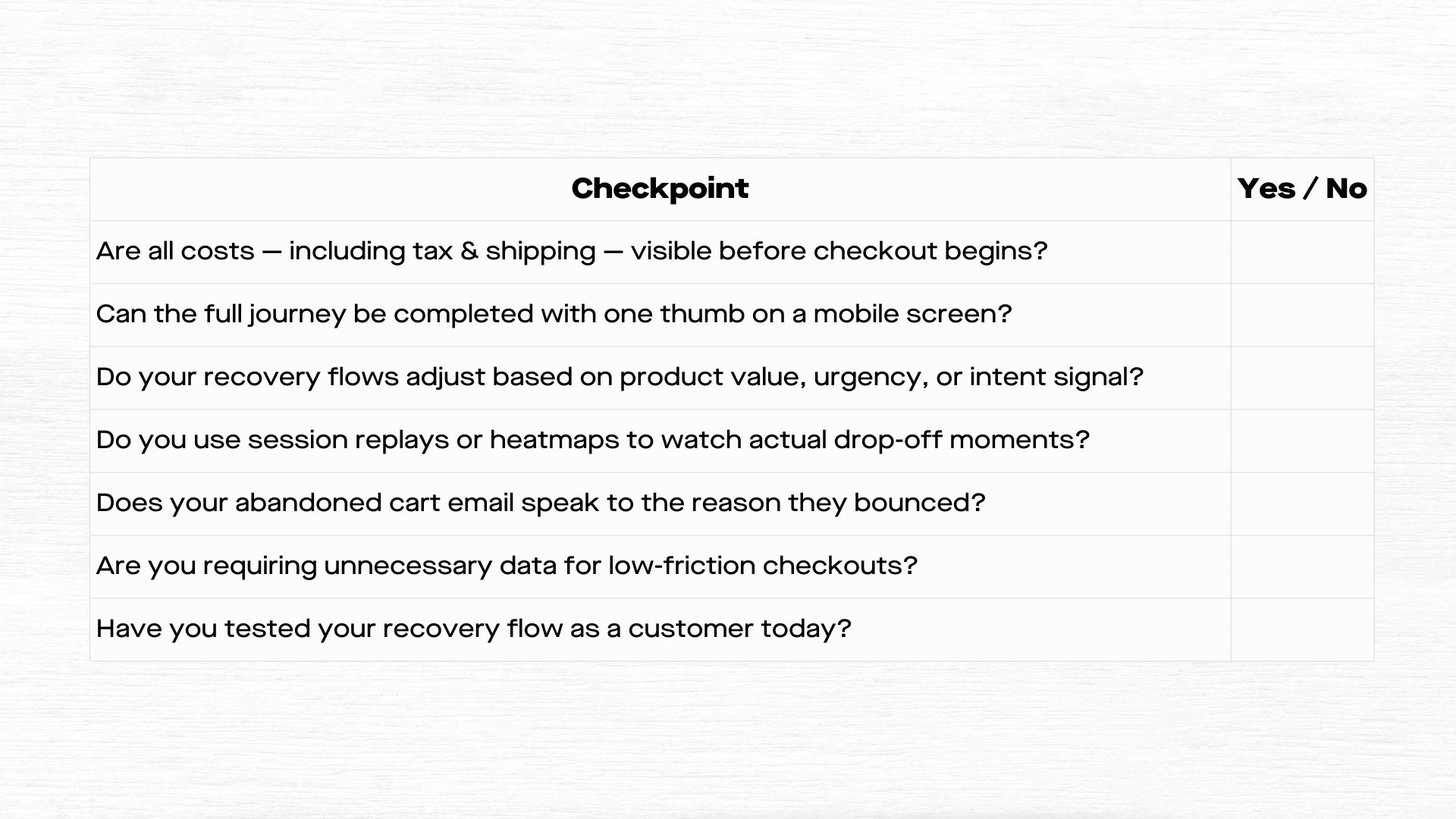

4. Cart Recovery Audit Starter Checklist

Not a template. A teardown.

Start here before writing a single recovery email:

(If you can’t tick 5 or more of these — you’re not recovering, you’re automating the wrong problem.)

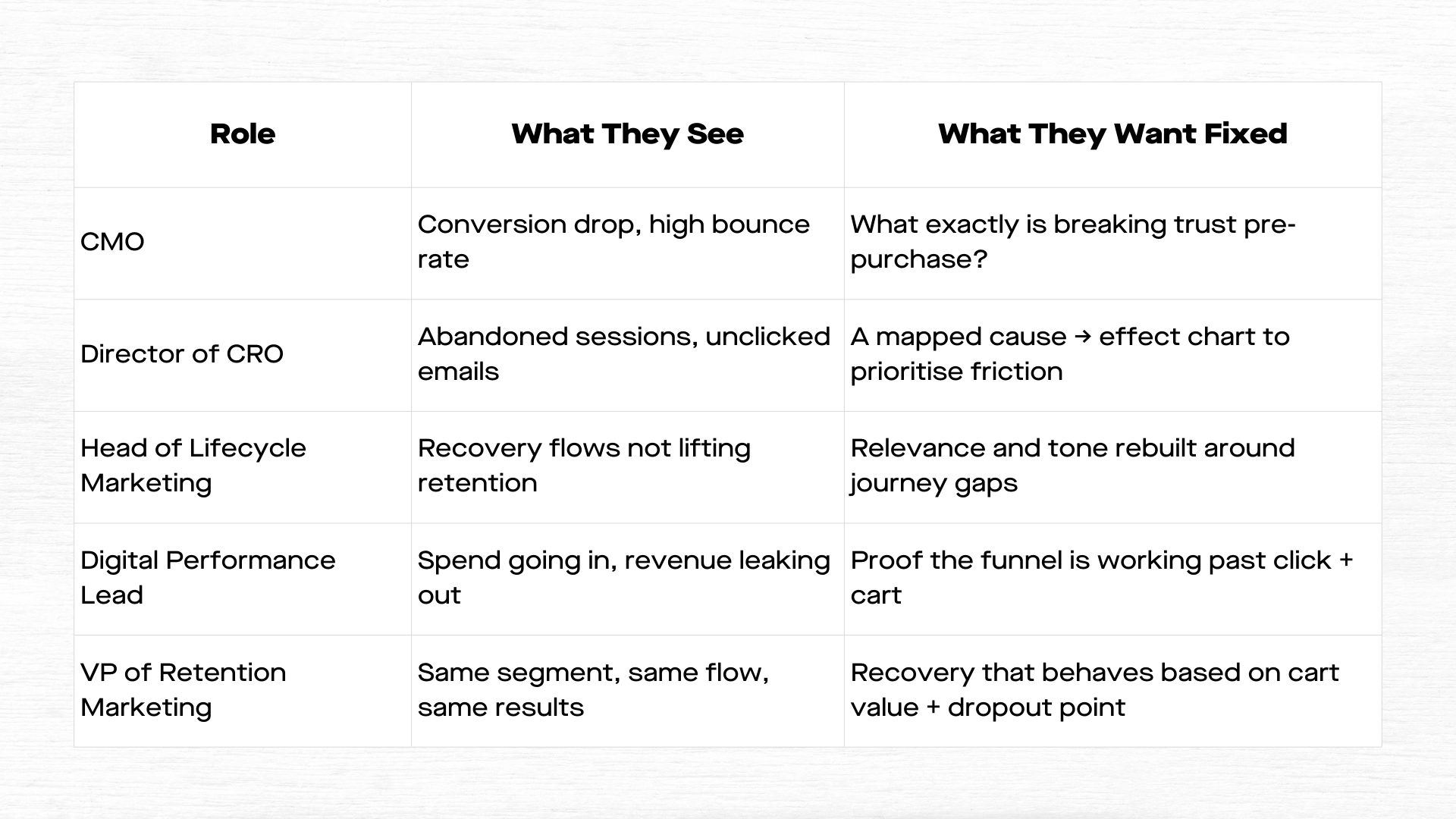

5. Insight: Recovery Looks Different Depending on Who You Are

Agencies pitch recovery like it’s a one-size solution.

But the pain hits differently depending on the persona.

If your recovery flow doesn’t serve these five views, it’s not strategic — it’s generic.

6. Stop Recycling the Same Mistakes

Cart recovery has become mechanical. The same flows, the same logic, the same “best practice” recycled across brands like it’s still 2016.

If your agency is following the checklist below, you’re not recovering revenue — you’re reinforcing the problem:

1. Triggering emails based solely on time, not on intent signals

- Sending an abandoned cart email 30 minutes after a bounce might feel responsive, but it’s disconnected from behaviour.

- If the shopper left because they were confused, cautious, or price-sensitive — time alone won’t fix it.

- Recovery should be triggered by actions: where they paused, what they hovered over, what they removed from the cart before leaving.

- If you’re only using time as a trigger, you’re ignoring the “why.”

2. Ignoring rage clicks, dead zones, and scroll stalls

- If your team isn’t watching session replays or heatmaps, you’re flying blind.

- There are visual cues that tell you exactly where the drop-off starts — repeated clicks on unresponsive buttons, form loops, abandoned fields.

- These aren’t just UX flaws. They’re trust failures.

- And if your agency hasn’t raised these during an CRO Audit, they’re not doing their job.

3. Writing recovery emails that try to be witty instead of helpful

- A well-designed, brand-approved email isn’t the goal.

- If the copy doesn’t sound like something a real human would say — in tone, timing, and clarity — it won’t convert.

- “Oops! Looks like you left something behind ” is not recovery. It’s lazy.

- Effective recovery emails anticipate the objection and resolve it quickly.

Not clever. Clear.

4. Guessing where the friction is instead of watching it unfold

- If your agency is diagnosing abandonment based on conversion rates alone, they’re missing context.

- Metrics will tell you where it happened. Behaviour will tell you why.

- The difference between a guess and a diagnosis is whether someone actually observed it.

- If you’re not watching, you’re assuming.

7. The Move? Run a Real Audit

Forget flows. Forget segments.

Start with:

- 10 session replays

- One end-to-end checkout test on mobile

- A flow that adapts tone + timing to cart size

- A review of actual dropout reasons, not benchmarks

Then — and only then — decide if you even need a recovery sequence.

Because sometimes the best recovery strategy?

Is fixing the thing that made them leave in the first place.

8. Want to Fix It? Don’t Add More. Strip It Down.

- Cut fields.

- Clean copy.

- Kill anything that’s not essential.

- Make recovery sound like a real person.

- Match tone to bounce point.

And if your agency isn’t already leading with this?

Then they’re not doing recovery.

They’re just following automation best practice.

9. Want help? Start with an audit — not a pitch.

Our Conversion Rate experts will watch the real sessions. Pull the real frictions.

Then show you what’s actually worth fixing.

10. Persona Views (why it hurts differently)

Not all abandonments are equal. The pain—and the fix—depends on who’s buying.

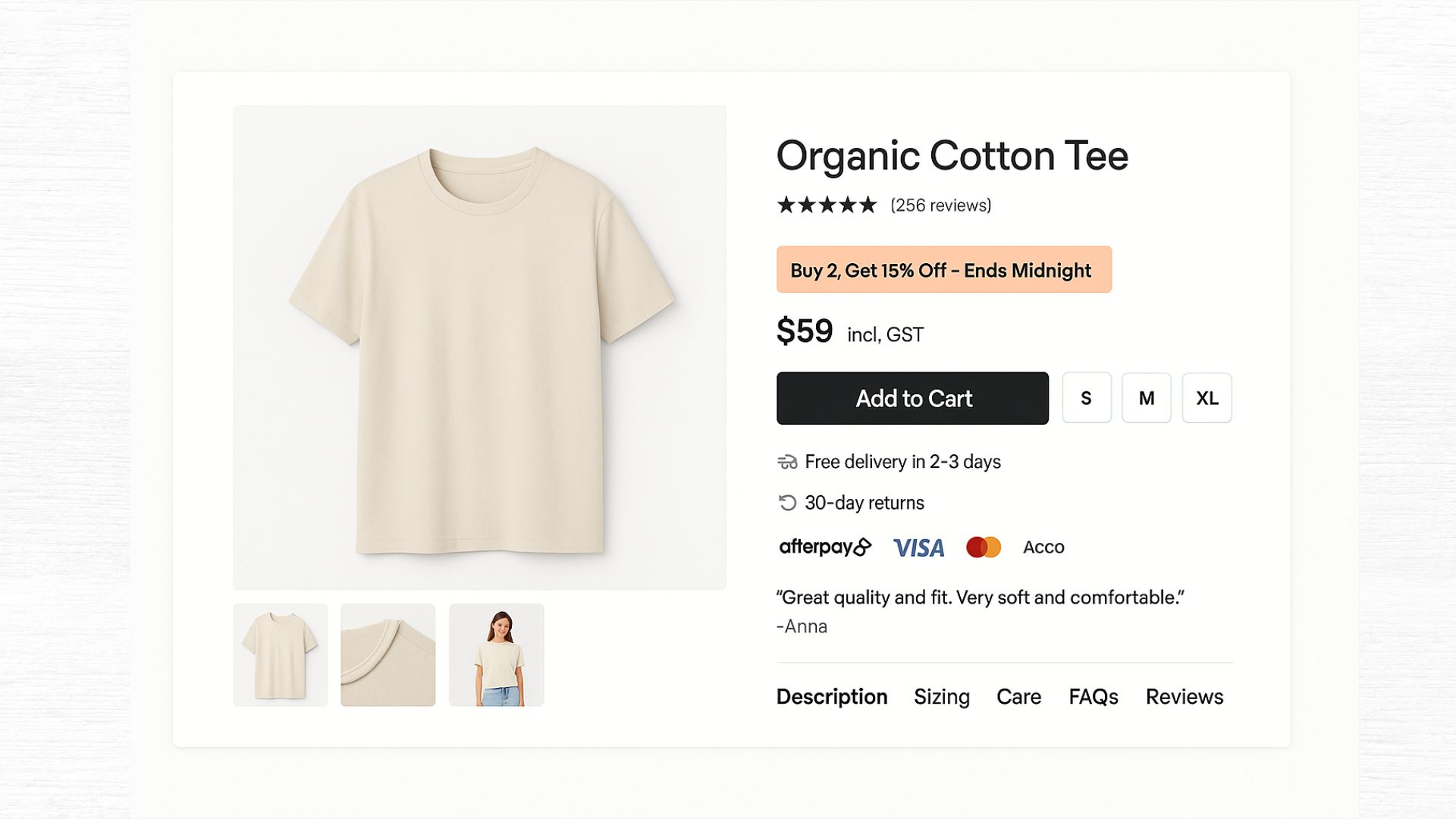

First-time shopper

- Likely hesitation: “Will it arrive on time? Can I return it easily?”

- What to show: Delivery window near the CTA, plain-English returns line, payment trust badges.

- Quick win: Add a one-liner above totals: “Arrives to metro areas in 2–4 business days. Free 30-day returns.”

- Measure: Cart→Checkout rate on first sessions, clicks on delivery/returns links.

Returning customer (not logged in)

- Likely hesitation: “This is taking longer than last time.”

- What to show: Guest checkout prefilled via browser auto-complete, progress indicator, one-tap wallet options.

- Quick win: Re-order methods so wallets appear first on mobile.

- Measure: Time on shipping step, wallet selection rate.

High-value basket (AOV in top quartile)

- Likely hesitation: “Is this safe? What if it’s not right?”

- What to show: Warranty/returns near the pay button, courier options, signature on delivery.

- Quick win: Add a compact “Peace of mind” block above the CTA: “Free returns • 12-month warranty • Signature on delivery available.”

- Measure: Final-step abandonment, switches between shipping methods.

Regional/remote buyer

- Likely hesitation: “Delivery cost and timing to my area.”

- What to show: Postcode estimator from PDP/cart, clear ETA ranges, any surcharges stated early.

- Quick win: Postcode lookup on cart with ETA + cost.

- Measure: Exits after postcode entry, changes to shipping method.

Trade/B2B buyer

- Likely hesitation: “Do you support invoices, ABNs, or PO references?”

- What to show: Company/ABN fields, invoice terms, downloadable tax invoice note.

- Quick win: Small line on payment step: “Need an invoice or PO? Add details here.”

- Measure: Checkout exits where PO/ABN fields appear, conversion by payment method.

Gift buyer / time-sensitive

- Likely hesitation: “Will it arrive before the date?”

- What to show: Cut-off times for Express, gift receipt option.

- Quick win: Countdown to dispatch cut-off on PDP and cart.

- Measure: Express shipping uptake, abandonment when ETA is unclear.

11. Payment Failure Playbook (what happens after “declined”)

Treat a decline as recoverable friction, not the end of the journey.

1) On-page handling (immediate)

- Plain message (no codes):

“That didn’t go through. It can happen for lots of reasons. Try again or choose another method below.” - Offer alternatives: Show PayPal/BNPL first, then card retry.

- Guidance: Short tips under the error—“Check card number and CVV. Some banks require 3-D Secure approval in their app.”

- Support nudge: Link: “Need help? Chat now or call us on 0000 000 000.”

- Keep context: Preserve cart, shipping choice, and any applied discounts.

2) Smart retry logic

- Soft retry: Auto-reopen the payment sheet once after 5–10 seconds (no field wipes).

- Switch method CTA: Dedicated button—“Finish with PayPal instead” (or the most used wallet).

- Device hand-off (if relevant): Offer “Pay link to your phone” for desktop-to-mobile switch.

3) Follow-up (only with consent)

- Timing: If the user exits after a decline and consent exists, send a short message within 30–60 minutes.

- Email/SMS template:

Subject: Your order’s almost there

Body: Hi {First name}, your payment didn’t go through. You can finish in one step here: {Resume link}. Prefer PayPal or BNPL? Both are available. Questions? We’re on chat and phone. - Suppression: Do not send if a successful purchase occurs, or if the user reattempts within 10 minutes.

4) Edge cases to handle

- 3-D Secure loop fails: Provide a fallback link and advice: “Approve the notification in your bank app, then return here. If it doesn’t appear, choose PayPal/BNPL.”

- Card BIN blocks (issuer rules): Automatically surface an alternative method with higher success (e.g., PayPal).

- Partial authorisation / duplicate attempts: De-dupe events server-side; show assurance: “If a charge appears twice, the pending hold will drop off shortly.”

5) Instrumentation (GA4 + data layer)

- Events: add_payment_info, purchase, custom payment_decline (with decline_reason where available), payment_method_select, resume_checkout_click.

- Params: payment_method, device_category, basket_value_band, 3ds_flow (yes/no), retry_count.

- Dashboards: Decline rate by method, success-after-decline rate, time-to-resume, assisted revenue from resume links.

6) Ops ownership & SLAs

- CX: Monitors decline spikes, updates help copy, answers chats/calls within 2 minutes during trading hours.

- Dev: Keeps payment SDKs current, tests wallet flows monthly, maintains server-side de-duplication.

- Marketing: Manages consented follow-ups and suppression rules, reviews copy quarterly.

- Weekly ritual: Review top decline reasons and top-converting fallback methods; ship one improvement.

7) Copy you can paste (micro templates)

- On-page error (generic):

“Payment didn’t go through. Please try again or choose another method below.” - On-page error (3-D Secure):

“Please approve the bank security step in your app, then return to complete payment. No approval received? Try PayPal or BNPL.” - Checkout hint (trust):

“Secure checkout • Cards, PayPal, BNPL • Refunds processed in 3–5 business days.”